The Japanese economy can no longer rely on expansion of its population, and thus workforce and consumer markets, to grow. All—businesses, government, and households—must shed behaviors that set in under the deflationary environment if the country is to achieve both stable price increases and sustained economic growth amid a shrinking population.

Japan's Rising Interest Rates and Prices: Behavior change could help

Takeaways

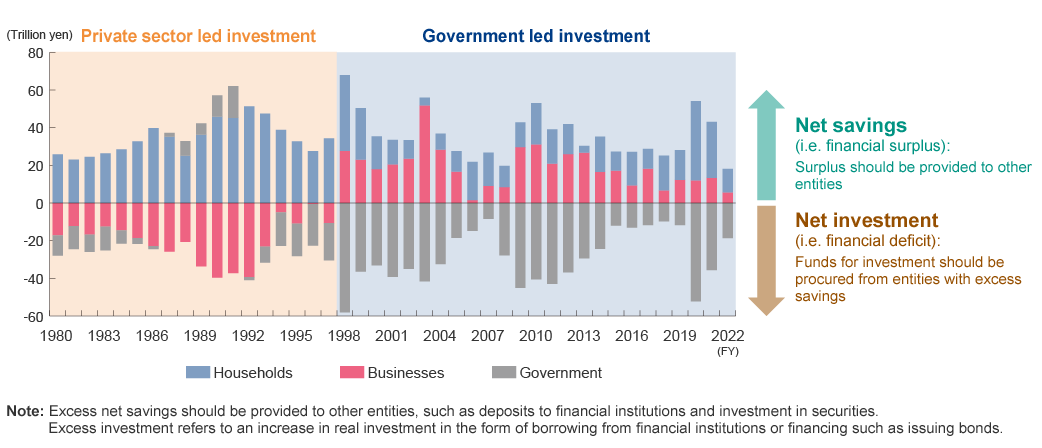

- Behavior change is required in all sectors to maintain economic growth as the population shrinks

- It is more crucial than ever for businesses to up their investment in physical and human capital if they are to better their profit margins

- The government must prepare for higher national-debt service expenditure, and households must bolster for dwindling asset value

The first step toward economic growth amid a shrinking population: shedding behaviors that set in under deflation

The Japanese economy can no longer rely on expansion of its population, and thus workforce and consumer markets, to grow. All—businesses, government, and households—must shed behaviors that set in under the deflationary environment if the country is to achieve both stable price increases and sustained economic growth amid a shrinking population.

Businesses need to invest in their workforces and set appropriate prices

That being said, consumer price increase taking hold does bring a few benefits; for one, businesses have an easier time setting, and raising, prices for their products. They should take this opportunity to invest in the latest technologies and human capital for greater added value, as well as improve their profitability through appropriate cost pass-through.

For example, if a business were to streamline work processes by deploying artificial intelligence, the freed-up resources could be utilized in adding value to existing products and services or planning new businesses. Workforce-facing initiatives too will become more important than ever such as wage increases to secure technically skilled personnel, a wage structure based on skill levels, and internal training programs.

*With regard to reduction of labor costs, labor share fell from 75.7% in fiscal 1999 to 67.5% in fiscal 2022 (source: Ministry of Finance, Financial Statement Statistics of Corporations by Industry; the survey covers all industries and businesses of all sizes excluding the finance and insurance sectors). Investment in growth was also curtailed during this period, and cash and deposits on hand increased by almost 90% (source: Bank of Japan Flow of Funds Accounts; survey includes non-financial businesses)

Government needs to rethink its fiscal policies

Expenditures to service national bonds are bound to spike when interest rates go up. The fiscal balance could temporarily improve thanks to tax revenue growth gained in the early stages of rising prices and interest rates, but expenses will inevitably increase as current bonds mature and the government refinances with higher interest rate bonds. The Ministry of Finance estimates that raising interest rates by a single percentage point will add 2.5 trillion yen to government bond expenses in three years’ time. Compared with pre-pandemic levels, the ten-year yield for government bonds has risen by one point, making this scenario increasingly realistic.

The government will lose public confidence in how it manages its finances if it fails to take more care with its fiscal policy. And this might cause consumers to tighten their belts further amid a heightened sense of crisis†. Instead of broadly redistributing temporary tax revenue increase to households in the form of tax cuts, the government must use the gains to achieve fiscal soundness and reduce debt, thereby relieving consumer anxiety in the longer term.

†In a survey conducted by Mitsubishi Research Institute, Inc. (MRI) in 2023, only 20% of households believed that the government could avert a fiscal crisis. The survey used MRI’s Market Intelligence & Forecast System (mif) and saw responses from 2,000 individuals from October 28-29, 2023

Households need to invest in inflation resistant assets

Behavior change begets sustained growth

In this context, the government can stimulate investments from the private sector by making policy more predictable, thereby lightening the fiscal load. We see both rising prices and interest rates as an opportunity for all three groups to change their behavior, making economic growth sustainable.

‡One example is a currently proposed policy to attract private-sector investment by the issue of Green Transformation (GX) Economic Transition Bonds with a total value of 20 trillion yen as a decarbonization initiative