Basic Approach

MRI’s basic corporate governance policy is to ensure the proper execution, based on our management philosophy, of activities that sustainably improve corporate value, which is the aggregate of four values: social value, customer value, shareholder value, and employee value.

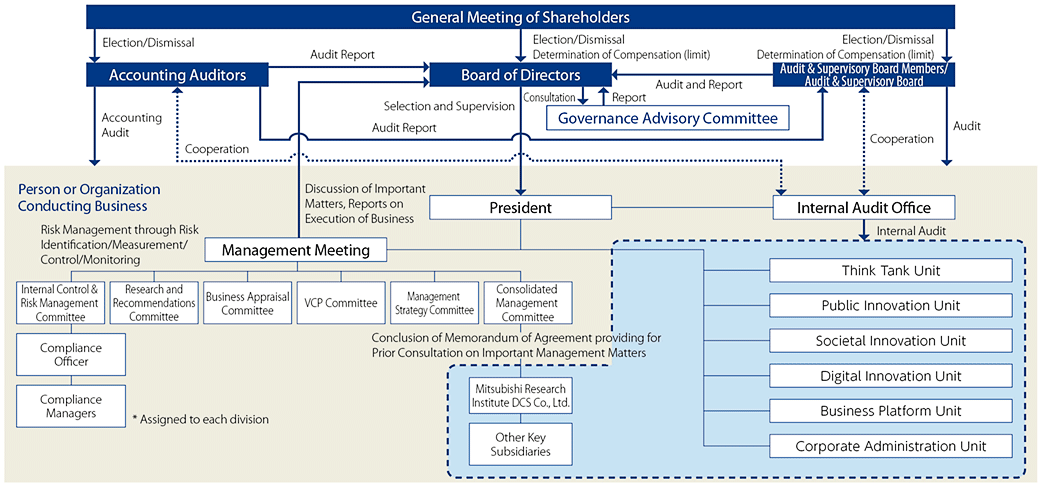

Outside directors form a majority of MRI's directorship, and outside audit & supervisory board members also form a majority of our audit & supervisory board members. This composition allows us to actively employ an outside perspective in our management decisions. Management meetings settle matters concerning the execution of business in line with the basic management policy established by the board of directors. Executive officers then implement decisions. When deciding on crucial matters, we consult with various internal committees before the management meetings.

MRI also has a common Code of Conduct, the Mitsubishi Research Institute Corporate Governance Guidelines, and a System to Ensure Appropriate Conduct of Operations (Internal Control System) that are shared with Mitsubishi Research Institute DCS Co., Ltd. and all other Group subsidiaries and affiliates. These shared the aims of codes, guidelines, and systems serve as the foundation of our common values and ethics.

Outside directors form a majority of MRI's directorship, and outside audit & supervisory board members also form a majority of our audit & supervisory board members. This composition allows us to actively employ an outside perspective in our management decisions. Management meetings settle matters concerning the execution of business in line with the basic management policy established by the board of directors. Executive officers then implement decisions. When deciding on crucial matters, we consult with various internal committees before the management meetings.

MRI also has a common Code of Conduct, the Mitsubishi Research Institute Corporate Governance Guidelines, and a System to Ensure Appropriate Conduct of Operations (Internal Control System) that are shared with Mitsubishi Research Institute DCS Co., Ltd. and all other Group subsidiaries and affiliates. These shared the aims of codes, guidelines, and systems serve as the foundation of our common values and ethics.

Board of Directors, Officer Structure, and Governance Advisory Committee

MRI's Board of Directors consists of nine directors (including five outside directors), and it has the authority to make decisions about our management and to supervise directors in the execution of their duties. Three of the five current outside directors have experience as managers of other companies, one is an educator, and one has broad experience and specialist skills relating to digital and technologies. This structure allows the outside directors to make decisions and monitor management from a broad perspective, based on their individual positions, experience, and knowledge. We work to make efficient and accurate decisions, and to clarify responsibility for business execution by selecting executive officers and by separating management from execution.

We have also established the Governance Advisory Committee to serve as an advisory body to the Board of Directors and asks for its opinions on matters such as the appointment and dismissal of the CEO and other key management personnel, officer compensation, and analysis and evaluation of the effectiveness of the Board of Directors. The Governance Advisory Committee deliberates and reports to the Board of Directors on matters consulted by the Board of Directors.

Audit & Supervisory Board and Audit & Supervisory Board Members

We have adopted a corporate structure of a Company with an Audit & Supervisory Board in accordance with the Companies Act and related laws and regulations. The Audit & Supervisory Board consists of five Audit & Supervisory Board Members (including three Outside Audit & Supervisory Board Members). Audit & Supervisory Board Members exercise their rights under the law to attend the General Meeting of Shareholders and the Board of Directors meetings, and to receive reports from Directors, Executive Officers, employees, and the Accounting Auditor. Audit & Supervisory Board Members effectively audit the Company by attending important meetings such as the Management Meeting and internal committees, receiving internal audit reports, and sharing the report results with all Audit & Supervisory Board Members.

Management Meeting and Executive Officer Meeting

The Management Meeting is composed of Executive Directors, Executive Officers holding a managerial position, and Unit managers. The Management Meeting discusses and decides important general matters concerning management based on the basic policies determined by the Board of Directors. It is held in principle regularly every Wednesday and on a temporary basis as necessary. In addition, Audit & Supervisory Board Members participate in every Management Meeting as monitors. The Executive Officer Meeting consists of Executive Directors, Executive Officers, and research fellows. In principle, Executive Officer Meetings are held once a month. In the Executive Officer Meeting, Executive Directors ascertain the status of business execution on the part of the Executive Officers and inform the Executive Officers of the instructions and decisions of the Board of Directors on behalf of the Board of Directors. The President explains the current status of management to the Executive Officers and issues necessary instructions to each of them. Other Executive Officers and research fellows report on the execution of their own business or the status thereof.Various Internal Committees

We have established a variety of internal committees as advisory bodies to the Management Meeting.Regarding important management matters such as management strategy, consolidated management, internal controls, we ensure transparency and checks, and make it possible to decide on a variety of measures from a broad perspective—not just by specific management lines—by referring such issues to the Management Meeting after sufficient discussion by these internal committees chaired by officers.

Group Internal Controls

We have subsidiaries and affiliates that include Mitsubishi Research Institute DCS Co., Ltd. We ensure corporate value improvement and appropriateness of operations as a group by sharing the aims of and stringently enforcing the “Code of Conduct,” “Mitsubishi Research Institute Corporate Governance Guidelines,” and “System to Ensure Appropriate Conduct of Operations (Internal Control System)” as a corporate group.In addition, we have signed a business management agreement with Mitsubishi Research Institute DCS Co., Ltd., which is a particularly important subsidiary, requiring prior consultation with us regarding important matters of its management. At the same time, we have a Consolidated Management Committee and have established a system whereby the Executive Directors regularly check on its management situation. Furthermore, through operational auditing by the internal audit department, we have established a system to ensure the appropriateness of operations of each group company to restrain and prevent violations of laws and regulations or unlawful behavior.

Election / Dismissal of Directors and Audit & Supervisory Board Members

The election/dismissal of our Directors and Audit & Supervisory Board Members is based on the “Basic Policy.” Specifically, the Board of Directors will determine the candidates, and the General Meeting of Shareholders will elect or dismiss them in accordance with the provisions of laws and regulations. Regarding candidates for Audit & Supervisory Board Members, we obtain the consent of the Audit & Supervisory Board in advance.

(2) A person who demonstrates the necessary insight, high ethical standards, experience, ability and qualifications as an officer.

(3) For outside officers, a person who has the experience, ability and qualifications to rigorously monitor and provide advice from the viewpoint of an outside third party with regard to our management.

Basic Policy for Election of Officers

(1) A person who always puts our management philosophy into practice.(2) A person who demonstrates the necessary insight, high ethical standards, experience, ability and qualifications as an officer.

(3) For outside officers, a person who has the experience, ability and qualifications to rigorously monitor and provide advice from the viewpoint of an outside third party with regard to our management.

Independence Evaluation Standards for Outside Directors and Audit & Supervisory Board Members

MRI considers outside directors and outside auditors to be independent only when none of the following conditions apply to them.

(1) Main business partners

(1) Main business partners

(a) Persons whose main business partners are MRI or MRI subsidiaries, or persons who execute business on their behalf

(b) MRI’s main business partners or persons who execute business on their behalf

(2) Experts

(b) MRI’s main business partners or persons who execute business on their behalf

Consultants, accountants, or legal experts who receive a large amount of remuneration or other assets other than officer compensation from MRI (in the event that said assets are received by corporations, associations, or other organizations, this condition applies to members of said organization)

(3) First and second degree relatives of persons one or more of the following applies (excluding persons not classified as important)

(a) Persons to whom (1) and (2) apply

(b) Persons executing business on the behalf of MRI subsidiaries

(c) Persons to whom (b) have recently applied, or who have recently executed business on behalf of MRI

(b) Persons executing business on the behalf of MRI subsidiaries

(c) Persons to whom (b) have recently applied, or who have recently executed business on behalf of MRI

Officer Compensation

Our officers’ compensation is based on the Basic Policy below. Specifically, after deliberations by the governance advisory committee, the board of directors decides on directors' compensation, and the audit & supervisory board determines its board members’ compensation through discussion.

(2) To ensure accountability to our stakeholders, we will decide officer compensation through an appropriate process that guarantees transparency, fairness, and reasonableness.

(3) To secure talented individuals essential for our continued growth, we will aim to set officer compensation at levels that are attractive over the long term.

The breakdown of officer compensation is as follows.

Basic Policy Regarding Officer Compensation

(1) To put in practice a management policy that responds to the mandate of the shareholders, we will have a fair compensation system that motivates officers to execute their duties.(2) To ensure accountability to our stakeholders, we will decide officer compensation through an appropriate process that guarantees transparency, fairness, and reasonableness.

(3) To secure talented individuals essential for our continued growth, we will aim to set officer compensation at levels that are attractive over the long term.

The breakdown of officer compensation is as follows.

- Internal officers: Basic compensation will consist of base pay, variable monetary compensation, and variable stock compensation. The intent of variable stock compensation is to motivate and incentivize officers to enhance business performance and corporate value over the medium to long term by linking their compensation to Group performance.

- Outside officers: Because these positions are independent of business execution, their compensation consists only of base pay.

- Audit & supervisory board members: To ensure independence, their compensation consists only of base pay.

Analysis and Evaluation of Effectiveness of the Board of Directors

The Governance Advisory Committee reviews the Board of Directors to improve effectiveness; the Board of Directors then analyzes and evaluates its own effectiveness and implements operational improvements.

In the fiscal year ended September 30, 2023, a questionnaire survey covering all Directors and Audit & Supervisory Board Members was conducted on composition and operation, supervision over strategy, appointment and compensation, and other matters. To make an evaluation ensuring objectivity, an external organization was utilized in design of the questionnaire, and evaluation and analysis of it.

As a result, our Board of Directors was highly regarded for engaging in constructive discussions and opinion exchanges in its supervisory function, being involved in challenges on strategies and sustainability, and appropriately performing its function based on a free and open atmosphere, and we have confirmed that the board functions effectively.

Regarding the management relating to significant risks and other matters that were recognized as issues in the previous fiscal year, opportunities for making reports and holding discussions were provided. We also confirmed that there was a certain amount of improvement in these issues, such as with initiatives that were implemented through the Governance Advisory Committee with respect to involvement in succession planning, and received constructive opinions in expectation of further efforts regarding the operation of the Board of Directors in the future.

On the other hand, in order to make the monitoring function of the Board of Directors more effective, we newly recognized other measures, such as the usefulness of providing opportunities for holding discussions in a planned manner regarding the progress of the Medium-term Management Plan 2026, which started in the fiscal year ending September 30, 2024, the progress of business strategies, and material risks and other important monitoring matters.

Based on such analysis and evaluation results, we will continue to enhance the effectiveness of the Board of Directors.

In the fiscal year ended September 30, 2023, a questionnaire survey covering all Directors and Audit & Supervisory Board Members was conducted on composition and operation, supervision over strategy, appointment and compensation, and other matters. To make an evaluation ensuring objectivity, an external organization was utilized in design of the questionnaire, and evaluation and analysis of it.

As a result, our Board of Directors was highly regarded for engaging in constructive discussions and opinion exchanges in its supervisory function, being involved in challenges on strategies and sustainability, and appropriately performing its function based on a free and open atmosphere, and we have confirmed that the board functions effectively.

Regarding the management relating to significant risks and other matters that were recognized as issues in the previous fiscal year, opportunities for making reports and holding discussions were provided. We also confirmed that there was a certain amount of improvement in these issues, such as with initiatives that were implemented through the Governance Advisory Committee with respect to involvement in succession planning, and received constructive opinions in expectation of further efforts regarding the operation of the Board of Directors in the future.

On the other hand, in order to make the monitoring function of the Board of Directors more effective, we newly recognized other measures, such as the usefulness of providing opportunities for holding discussions in a planned manner regarding the progress of the Medium-term Management Plan 2026, which started in the fiscal year ending September 30, 2024, the progress of business strategies, and material risks and other important monitoring matters.

Based on such analysis and evaluation results, we will continue to enhance the effectiveness of the Board of Directors.

Accounting Auditor

We strive to ensure the independence of the Accounting Auditor.

The Audit & Supervisory Board takes the following procedures in order to ensure proper audits by the Accounting Auditor.

(1) Standards are formulated in order to appropriately select and evaluate the Accounting Auditor.

(2) Confirmation is made as to whether the Accounting Auditor has sufficient independence and expertise to perform the accounting audit of MRI.

The Board of Directors and the Audit & Supervisory Board take the following procedures in order to ensure proper audits by the Accounting Auditor.

(1) Sufficient auditing time is secured to enable high-quality audits.

(2) Opportunities to consult with the Representative Directors, Executive Directors, Outside Directors and other relevant parties are provided, at the request of the Accounting Auditor.

(3) A system is put in place which allows for sufficient coordination between the Accounting Auditor and the Audit & Supervisory Board Members, the internal audit department and the Outside Directors.

The Audit & Supervisory Board takes the following procedures in order to ensure proper audits by the Accounting Auditor.

(1) Standards are formulated in order to appropriately select and evaluate the Accounting Auditor.

(2) Confirmation is made as to whether the Accounting Auditor has sufficient independence and expertise to perform the accounting audit of MRI.

The Board of Directors and the Audit & Supervisory Board take the following procedures in order to ensure proper audits by the Accounting Auditor.

(1) Sufficient auditing time is secured to enable high-quality audits.

(2) Opportunities to consult with the Representative Directors, Executive Directors, Outside Directors and other relevant parties are provided, at the request of the Accounting Auditor.

(3) A system is put in place which allows for sufficient coordination between the Accounting Auditor and the Audit & Supervisory Board Members, the internal audit department and the Outside Directors.