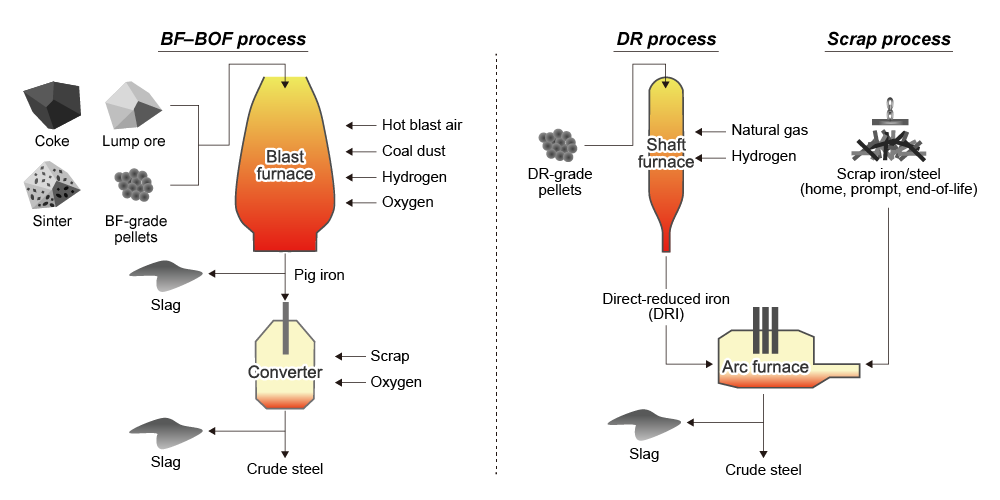

The blast furnace–basic oxygen steelmaking (BF–BOF) process* used to produce just over 70 percent of Japan's crude steel necessitates the use of fossil fuels, such as coal and gas, to generate the massive amount of heat required throughout the process, as well as the use of coke to remove oxygen during ore smelting.

For this reason, more and more steelmakers, especially in Europe, are turning to processes that entail lower CO2 emissions—ones using scrap as feedstock or hydrogen in direct reduction (DR)† .

There is no easy way for Japan to transition to direct hydrogen reduction as the country is ill-positioned for the procurement of green hydrogen‡ and the capture and sequestration of CO2 (CSS)§ required in blue hydrogen production¶. Japan's steelmaking industry is therefore taking a gradual approach to greening itself designed to ultimately achieve carbon neutrality through multiple routes.

*Coke and iron ore are the principal feedstocks for blast furnaces; iron scrap is that for electric arc furnaces (EAFs)

†Fueling direct reduction with hydrogen instead of the conventionally used natural gas

‡ Producing hydrogen without generating any CO2, by using electricity generated with renewables to reform hydrogen from water

§The process of separating out, capturing, and storing CO2 deep underground

¶Hydrogen considered carbon neutral because the CO2 resulting when it is produced from a fossil fuel, is separated out and fixed