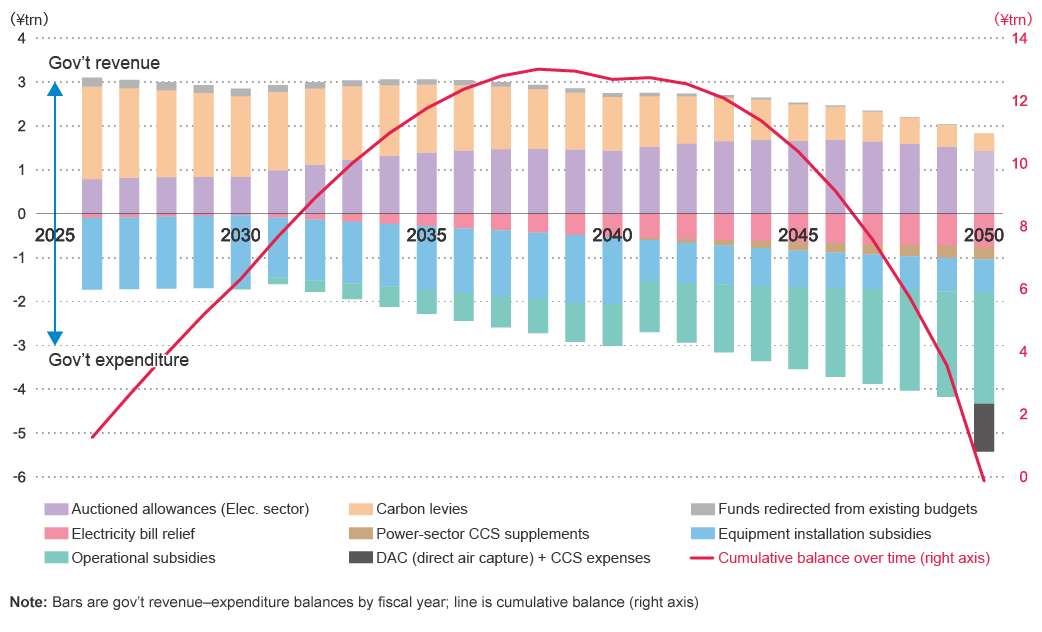

Japan’s taxpayers will inevitably have to pick up more of the tab if government assistance for decarbonization hits the ¥70 trillion level. And further, analysis suggests that the carbon pricing scheme could well wind up systemically skewed to be hardest on small emitters in the consumer and industrial sectors*, though this depends on the scheme’s final design.

We therefore believe that, to bolster the scheme, consensus needs to be built upon debate which, along with carefully discerning how much of the costs everyday consumers and businesses can bear, addresses head-on the best way to distribute decarbonization costs fairly across economic and business sectors.

Our analysis posits scenarios on the way to carbon neutrality in 2050 that, while referencing the government’s technology development roadmap, envision ultimately recovering and eliminating CO2 from difficult-to-electrify heat-intensive industrial processes, by firing them with hydrogen or synfuels from abroad, to reach carbon neutrality by 2050. In reality, though, these are not the only viable scenarios, as ones envisioning other means are also possible.

Japan’s search for the optimum path to carbon neutrality is just getting started. People tend to focus on the massive amounts of money needed and on the development and deployment of the most advanced technologies; but in the end, these are not the most crucial elements of the undertaking. Rather, what Japan needs to do is identify winner domains—ones where it can overcome the rise in energy costs and prevail—and focus investments in those areas if it is, especially in the context of increasingly intense international competition, to ensure that green transformation-oriented government investment leads to economic growth.