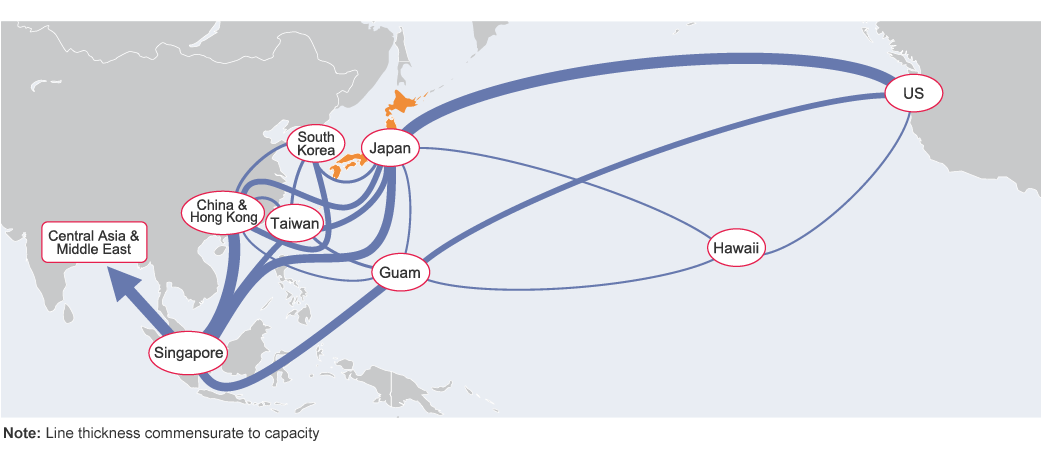

Content providers like Google and Meta embarking on laying their own undersea cables is an indicator of the advantages of controlling their services with their own cable systems. Further, there’s much to be gained from considering together the siting of data centers and cable landing-points. For instance, most cables landing in Japan connect to Internet exchanges in Tokyo or Osaka—which means that over 80 percent of Japan’s data centers are concentrated in the outskirts of Tokyo and Osaka.

A further issue that dogs data centers is that of power. For example, Singapore—typical of areas with high concentrations of data centers in Asia—has begun limiting their new construction because of problems like their burden on electricity supply. Data center siting is also influenced by many other factors, including other communications infrastructure, energy costs, the availability of renewable energy, natural disaster risk, and political stability.

Hong Kong also has a high concentration of data centers, but the environment for doing business has changed since its return to China. With the search on for alternatives, Japan, Taiwan, and Indonesia have emerged as leading candidates, but as things stand each entails its own set of advantages and disadvantages. To enhance Japan’s advantages while making the most of its being a data traffic hub, the country needs to bring users and all other stakeholders together to strategically address two principal issues: power and dispersion.