Despite sub-par prospects for export growth due to a slowing global economy, we expect the Japanese economy to recover to growth in the mid 1% range, driven mainly by domestic demand.

Factors that should help boost growth include an expected recovery in out-of-home spending post-pandemic, the economic stimulus package passed in December 20223, and a rebound in inbound traveler demand*.

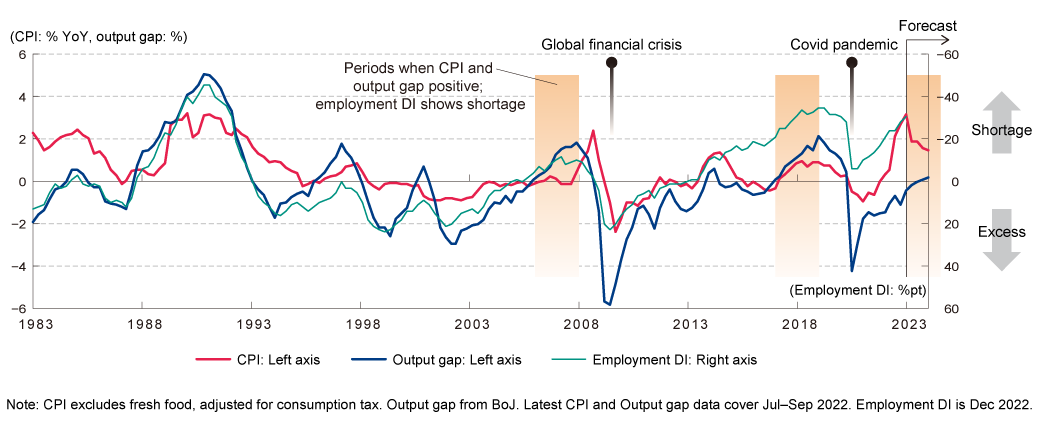

Corporate capital expenditure should also see solid growth. Target areas include decarbonization, digital transformation, and bolstering supply chain resilience. The output gap has improved and is likely to shift to positive output in the second half of 2023.

Over 2023, we are likely to see both upward and downward pressure on prices. Recent inflationary pressures from a weak yen and high resource prices are likely to moderate through the latter half of 2023 as the U.S. rate-rise cycle pauses and prices on global markets lower once the world economy slows down.

Meanwhile, prices in Japan have long been characterized by upward price rigidity, but moves to raise prices are emerging on numerous fronts. Cost pass-through has been less prevalent in Japan than in the U.S. and Europe, but there are signs of change emerging.

According to Tokyo Shoko Research4, companies that are passing through at least 50% of input cost increases accounted for 40% of the overall total as of December 2022, up from 20% in February 2022. Corporate expectations for inflation five years down the line are also rising5, making the environment more conducive to price hikes.

Concurrently, the proportion of companies increasing wages has also reached a historical high6. The aim is to recruit and maintain workforces amid a labor shortage. While real wage growth has been negative YoY recently, it should turn positive in the second half of 2023.

*We anticipate contributions to real 2023 GDP of +0.4ppt attributable to economic policies and +0.2ppt attributable to expanding inbound demand