The MRI Group's philosophy, as set forth under its New Guiding Principles, is to continually envision a desirable future, resolve societal issues, and lead change in society to co-create a prosperous, sustainable future. Based on this philosophy, we engage in sustainability management that contributes to the improvement of our non-financial and social values.

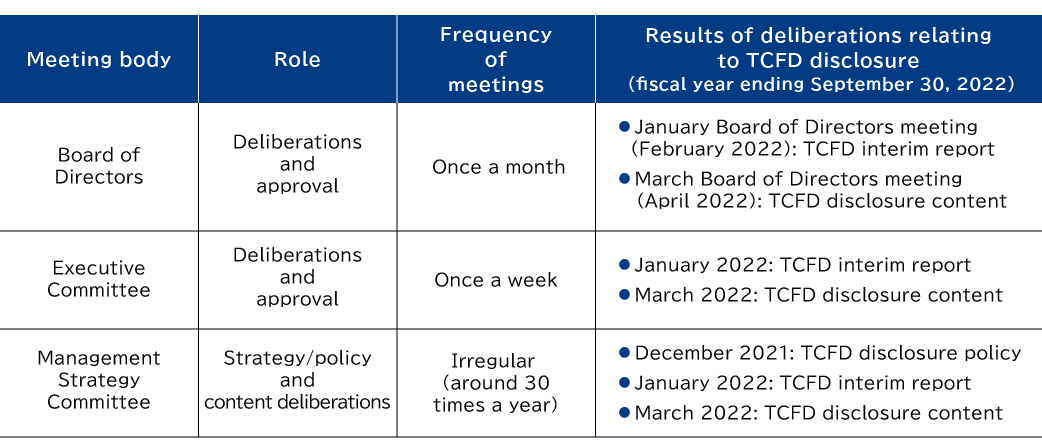

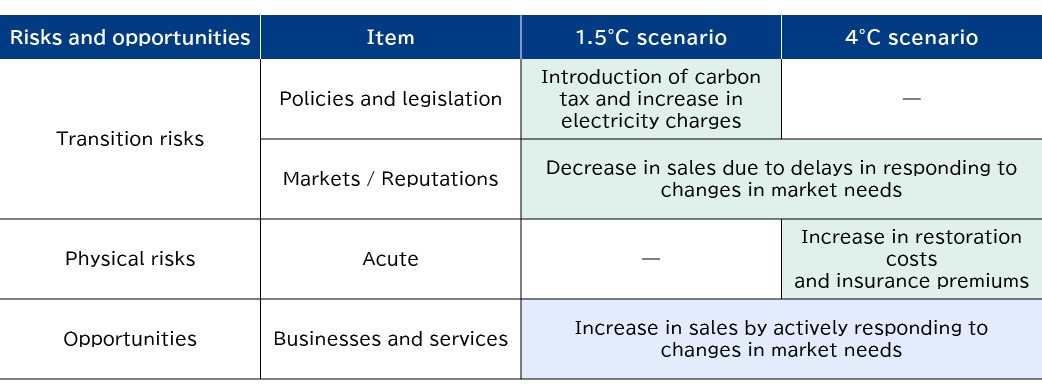

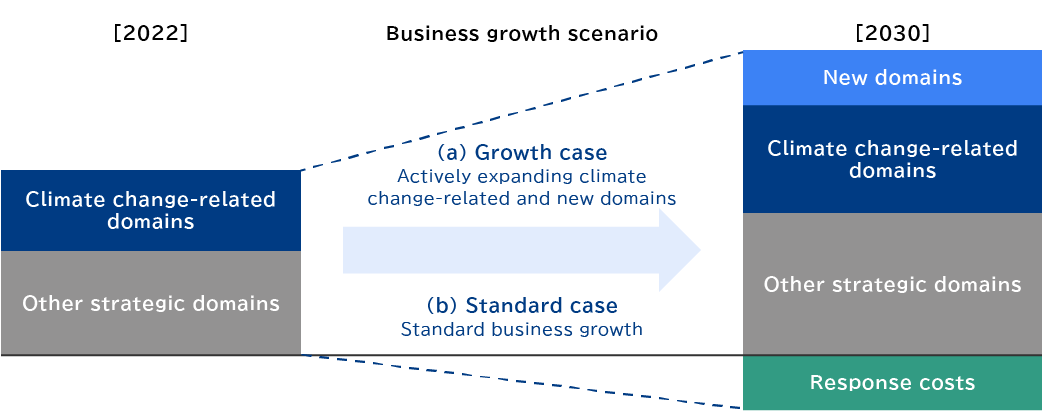

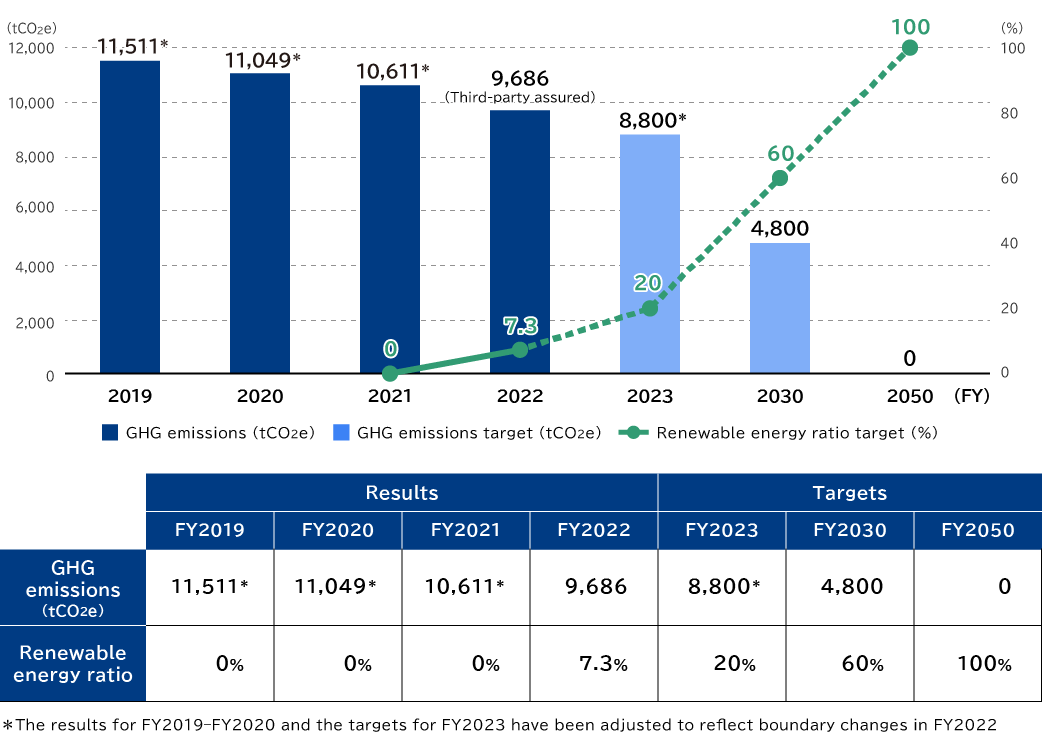

We regard climate change as a key issue that should be addressed by society as a whole and are contributing to the improvement of social value, through efforts such as policy recommendations, strategy formulation for private-sector corporations, platform operation—such as in the operation of the TCFD Consortium—and mega solar projects as one form of real-world implementation geared toward decarbonization.

We regard climate change as a key issue that should be addressed by society as a whole and are contributing to the improvement of social value, through efforts such as policy recommendations, strategy formulation for private-sector corporations, platform operation—such as in the operation of the TCFD Consortium—and mega solar projects as one form of real-world implementation geared toward decarbonization.

The MRI Group's Vision for a Carbon Neutral Society

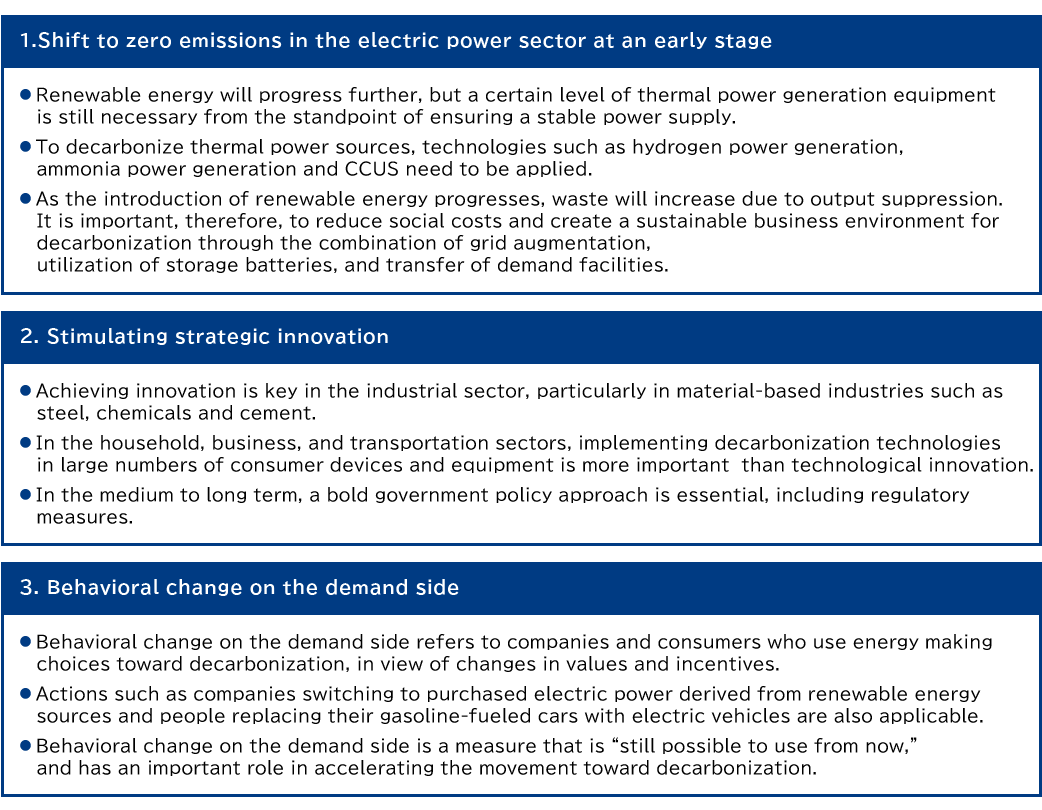

Major countries and regions around the world have made declarations regarding carbon neutrality, and the shift toward decarbonization is now a global trend. In October 2020, Japan also made a declaration pledging to become carbon neutral by 2050. However, thermal power generation still accounts for over 70% of Japan's total power generation, and the ratio of energy consumption in the industrial sector is large, making it more difficult for Japan to achieve carbon neutrality than other countries. In light of this situation, in September 2021, Mitsubishi Research Institute published its Recommendations for Achieving Carbon Neutrality by 2050 and outlined three key points for achieving carbon neutrality by 2050, along with concrete measures to support transformations toward that goal.

It is important for society as a whole to regard these initiatives as investments for the future—as opposed to costs—and link them on to new industrial competitiveness. The participation of all stakeholders, including consumers, companies, national and local governments, research institutions and non-profit organizations will be essential to achieving carbon neutrality.

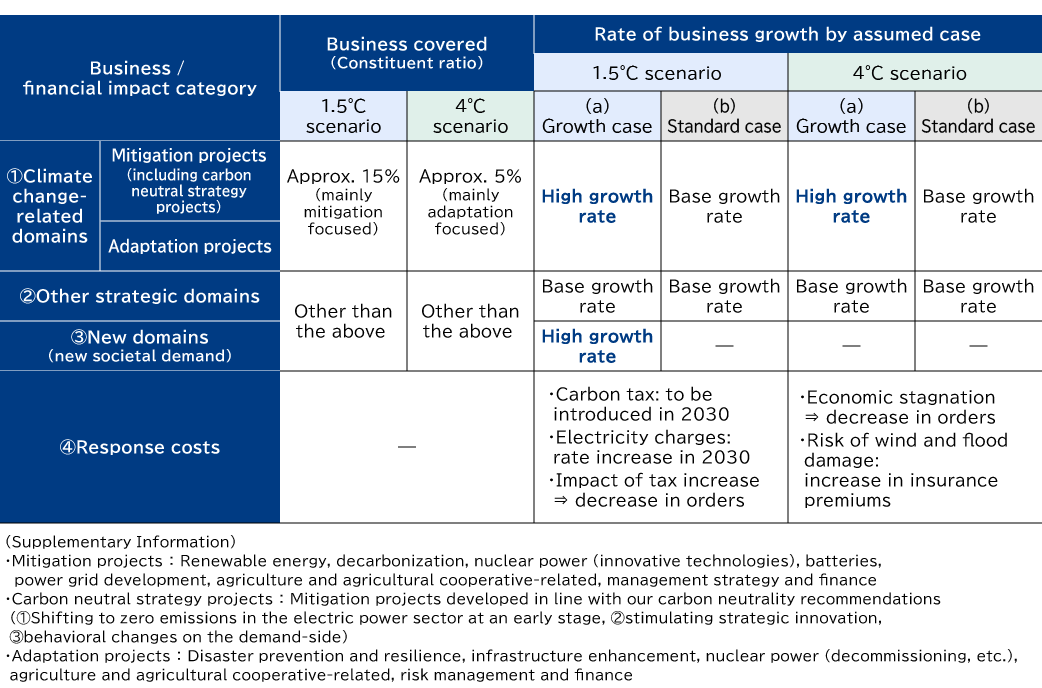

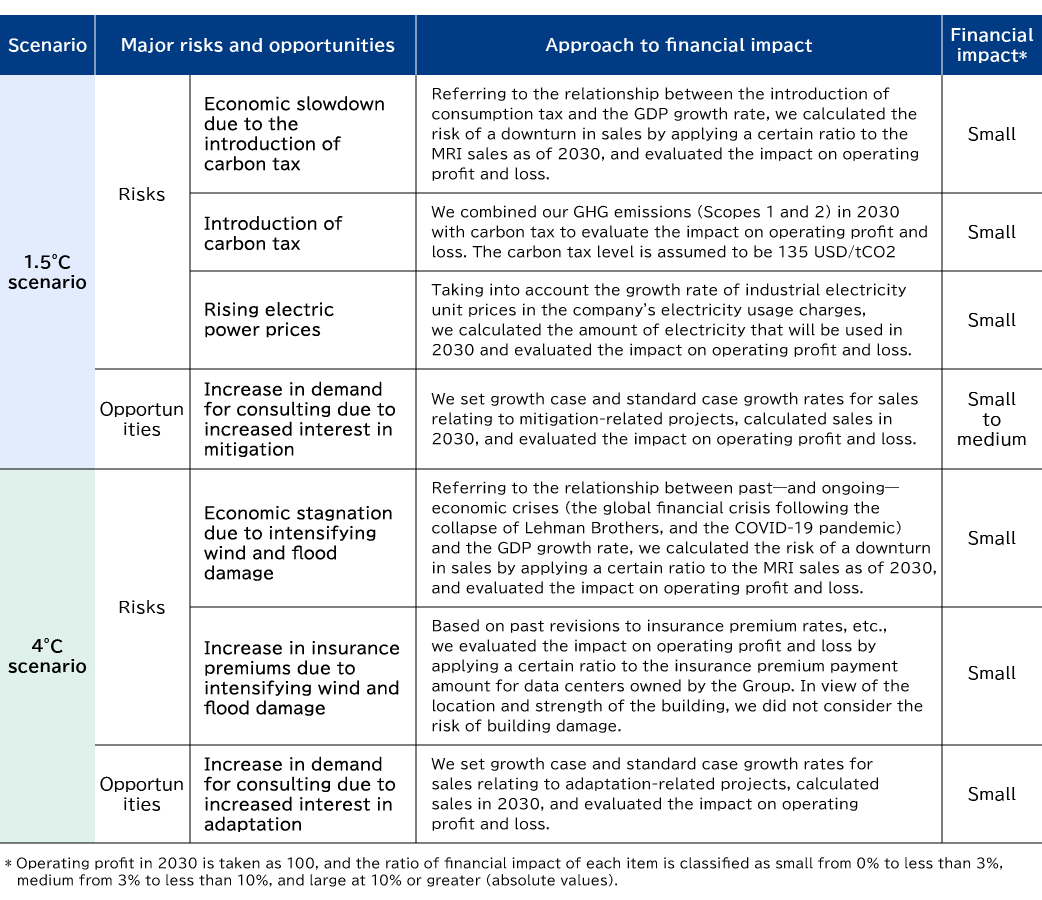

We are pushing ahead with policy recommendations, research activities, and consulting to provide support for the efforts of all stakeholders taking on challenges toward achieving carbon neutrality.

It is important for society as a whole to regard these initiatives as investments for the future—as opposed to costs—and link them on to new industrial competitiveness. The participation of all stakeholders, including consumers, companies, national and local governments, research institutions and non-profit organizations will be essential to achieving carbon neutrality.

We are pushing ahead with policy recommendations, research activities, and consulting to provide support for the efforts of all stakeholders taking on challenges toward achieving carbon neutrality.

Three Key Points for Achieving Carbon Neutrality by 2050